(This post is the first installment in a multi-part series)

Last year on April 1, we brought you Toucanomics. This year, we give you tokenomics.

Shell Protocol was built to be a neutral, non-custodial, and open-source tool for making and combining financial services, from trading to lending to selling NFTs. Although Shell launched in September 2022, and its predecessor Shell v1 was launched over a year earlier, we have not yet released a governance token. Why?

An absurd number of blockchain projects start with a token and fail to deliver on the product, so much so that it has become a stereotype of the industry. In contrast, we wanted to first get to know our community and their values (numerous Discord members have logged on to voice their governance ideas), establish Shell Protocol as an innovator, find product-market fit, harden our security, and most importantly, demonstrate the need and long-term sustainability of a governance token in supporting the project.

Because Shell is a neutral DeFi platform intended as a public resource, the tokenomics were designed with the philosophy of governance minimization—to reduce any possibility of compromising our core principles. With this in mind, it’s time to reveal the design of the $SHELL token and its avatar, the Shell DAO.

This blog post will detail exactly how the $SHELL token generates value, how it can (and cannot) govern the protocol, and why it must exist in the first place.

But first, let’s start with a brief discussion of what Shell Protocol has achieved and how it might evolve in the future.

Composable Utopia

At its heart, Shell is a composability solution for DeFi. Can you imagine hailing a driver on Uber, tracking their location on Google Maps, messaging them on WhatsApp and paying them with Venmo? That’s what DeFi feels like today because it lacks composability. Basic tasks such as migrating funds between pools requires sending numerous transactions and interacting with multiple applications. When you use DeFi, how many tabs do you have open in your browser at any given time?

Although the Shell App and ecosystem is still in its early stages of development (after all, the Ocean is only six months old), we can already see how Shell’s composability improves the user experience.

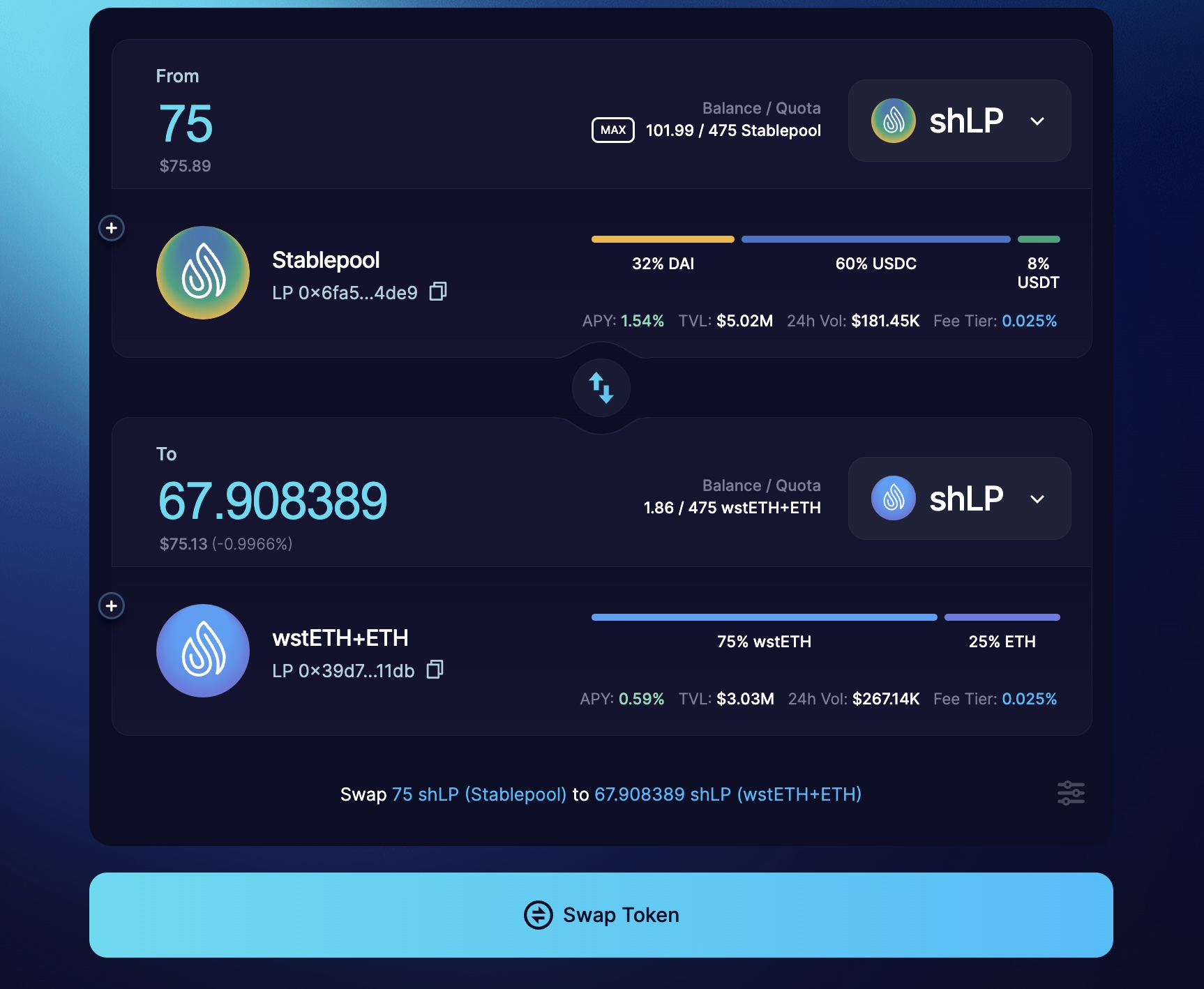

Suppose Alice wants to migrate her funds from one LP position to another, for example from the Stablepool (USDC+DAI+USDT) to the wstETH+ETH pool. With any other DeFi app, she would have to withdraw the three underlying stablecoins of the first pool, then swap each one for equal amounts of both ETH and wstETH. Finally, she gets to deposit into the wstETH+ETH pool.

That would take at least five separate transactions and require Alice to do a fair amount of math to get the ratios correct. However, on the Shell app, Alice can complete this operation in a single swap: Stablepool -> wstETH+ETH.

As the Shell ecosystem evolves, we’ll see all sorts of financial primitives built on Shell: lending pools, NFT fractionalizers, NFT AMMs, derivatives, AMMs for derivatives, liquidity bootstrapping pools, and so on. No matter how different each primitive is in purpose or design, any set of transactions can be batched together via a scripting language.

The more primitives that join the ecosystem, the more options for composability, which in turn puts more power in the hands of users—enabling them to move value in arbitrarily complex ways. It’s a positive network effect for the whole ecosystem.

Value Generation

Let’s return to tokenomics and start by answering the question, how does Shell Protocol generate value?

Shell Protocol is like a nightclub that is free to enter but costs money to leave. You can stay in the nightclub as long as you want—days, weeks, even years, all the while having a great time without paying a cent. It’s only the moment you walk out the door that you pay an exit fee.

Wrapping tokens into Shell’s accounting layer, the Ocean, is free. It is also free to move your tokens around Shell, whether that means transferring your tokens to other addresses within the Ocean, or using them with various applications in the Shell ecosystem—no matter if you make ten transactions or ten thousand. However, if you want to unwrap tokens, aka remove your liquidity from the Shell ecosystem, you have to pay a percent fee. (The current fee is set to zero). As more people use Shell, more volume will flow in and out of the Ocean, and the protocol collects more revenue.

The Shell DAO will be the beneficiary of this revenue. $SHELL token holders will collectively control the DAO via voting. Hence, $SHELL tokens directly benefit from the revenue collected by the Ocean.

Governance Minimization

This brings us to a second question, how does $SHELL govern Shell Protocol? By design, the Shell DAO has limited control over the Ocean. Here are some things it cannot do:

- It cannot manipulate or confiscate user assets (Shell is 100% non-custodial)

- It cannot freeze the protocol (users can always withdraw their assets at any time)

- It cannot block new primitives from joining (anyone can build and deploy on Shell)

In fact, the Shell DAO can only do three things:

- Increase or decrease the unwrap fee (maximum fee is 0.05%)

- Transfer the accrued protocol revenue to another wallet

- Change the protocol beneficiary to another wallet

The fee has a hard-coded cap of 0.05% to prevent wild rent-seeking behavior. It’s also a security measure—in case the DAO is compromised, an attacker can’t lock user tokens in the protocol by setting the fee to 100%.

What to do with the protocol revenue will be up to the DAO, and thus up to the $SHELL token holders. For example, they could distribute the funds amongst themselves. Or, they could reinvest the capital into further developing the protocol. Or, something else entirely.

Long-term Sustainable Development

Moving on, why does Shell even need a token? How will $SHELL benefit the protocol?

Building Shell Protocol and upgrading it in the future costs money—people don’t work for free, after all. Unless there is some way to generate value, the protocol won’t be maintained. Many public resources have fallen into this trap, especially in open-source technology.

Because $SHELL token holders are simultaneously the beneficiaries of Shell Protocol’s revenue, they are incentivized to reinvest in the protocol. With sustainable development of the product and ecosystem, token holders can grow those revenues in the future.

Without you, the future $SHELL token holders overseeing its development, Shell Protocol won’t be sustainable in the long run.

Next Steps

In the next Governance and Tokenomics post, we will discuss the distribution of $SHELL token, how Shell Points will be used to calculate the airdrop, and when we can expect the launch of $SHELL.

Join the Shell community!

Twitter: https://twitter.com/ShellProtocol

Discord: https://discord.com/invite/shell-protocol

Telegram: https://t.me/shellprotocol

GitHub: https://github.com/shell-protocol\